Niin metsä vastaa kuin sinne huudetaan.

The forest answers in the same way one shouts at it.

(Finnish Proverb)

After lunch there was again a difficult choice to make: Assessing Risk in Lending and Borrowing or Shipping Challenges. I could talk hours about shipping challenges in a Science and Technology Museum, but they are mainly inside my own institution, so I chose lending and borrowing.

“I look forward to hearing from you”: A lending and borrowing scenario was presented by Kate Parsons, Head of Collections Management at Tate, UK and Jane Knowles, Head of Exhibitions, Chair of the UK Registrars Group.

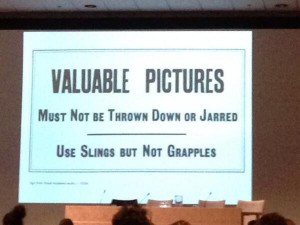

It started with a short look at the history of risk assessment in lending and borrowing with some hilarious finds concerning art transportation:

Generally speaking, there are three types of risks when it comes to loans:

1) Financial risks

2) Logistical risks

3) Curatorial and ethical risks

All the risks must be addressed as early as possible in the process. To show how to do this Kate and Jane established a scenario: The Royal Academy wants to loan some works of art from Tate. Taking the roles of the lender (Kate) and the borrower (Jane) they showed how the loan process is established, how risk assessment is done continuously on both sides and how communication is key.

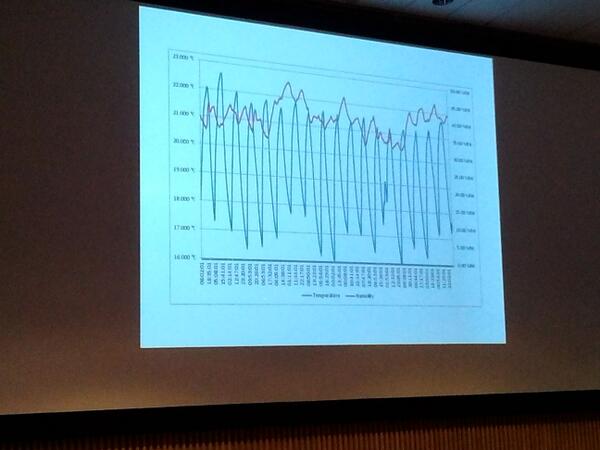

As most loan processes, the one in this scenario didn’t go smoothly. For example, the borrower sends in the climate graph of one of the exhibition rooms, which looked like this:

Is it okay for an alabaster sculpture? Well, even with considering very much in favor of the borrower, it isn’t… They have to find an alternative room for display and there are concerns because of the weight of the statue and transportation issues. In regards to another artwork the borrower finally decides to draw back his loan request. The lender has already invested time in conservation measures, so he sends an invoice for the costs, which, of course, the borrower didn’t expect and hadn’t accounted for. So it went on, but in the end they reached a good agreement for both sides and lived happy ever after…

Gee, I really wish all loan requests and procedures were handled in the decent, polite and collegial way of this scenario! That’s really acting in favor of the artworks, institutions and of course, the colleagues involved. In a nutshell: Lender and borrower should both work together and discuss risks openly and collegial. That’s good risk assessment

Next up was Eva-Lena Bergström with „Lending and Borrowing – Calculating Risks“. She took a look at the historical development of risk assessment in loans and especially on the development of state indemnity programs. Some of the facts and figures I recall (or could look up in my notepad):

- In 2009, 22 of 30 European countries had a state indemnity program

- Since then 2296 exhibitions were covered by state indemnity and there were 16 reported cases of damage/loss introduced for at least 100.000 artifacts included in these loans (0,016%).

- Out of 84 institutions that took part in Eva’s survey only 2 didn’t do risk assessment in any form.

This was followed by an in deep look at the data from the survey the ERC2014 delegates were asked to fill out online before the conference (hopefully published soon).

The following panel discussion soon focused on the practice that some loan contracts include a passage that the borrower can be held responsible for damage that becomes visible up to 6 months after the loan. This is a passage that seems to impose an unbearable risk on the borrower. But a German delegate stressed out that this might be a misunderstanding: under German law (as far as I understood it, but I am not a lawyer) the claim for compensation for an occurred damage during the loan period has to be done immediately after the loan is back. This makes it impossible to claim for hidden damages that only become visible a short time after the loan is back but that are caused evidentially by the conditions during the loan time. Therefore German loan contracts often include such a passage that expands the time to react on 6 months after the loan.

It became obvious that the wording in the contracts must be clear and that it’s not acceptable to take over uninsurable risks. Lending and borrowing is a key responsibility of museums and lenders must accept that every loan comes with certain risks that can’t be imposed completely on the borrowing institution.

This post is also available in Italian, translated by Silvia Telmon.